Last Updated on 21 October 2024 by CryptoTips.eu

eToro review [jaar]

This eToro review does not apply for US customers. When you are looking for the perfect broker to match your needs, it is good to look beyond the brokers that only focusses on cryptocurrency. Traditional trading platforms are regularly expanding their offer with crypto. At eToro you can trade commodities, currencies and stocks, but you can also choose from a nice selection of cryptocurrency. The availability of eToro is subjected to regulation.

When you visit eToro’s website, you will notice that eToro is a social trading platform. We will tell you exactly how that works in this eToro review.

| eToro | Details |

|---|---|

Open a free demo account 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

Buy real crypto with eToro Free demo account to practice Copy strategies from experts 90+ cryptos available Regulated by the FCA |

At eToro you buy real crypto

Let’s start this eToro review with some important information about this broker. eToro works with CFD’s and leverages. Let’s start with the first one. Unlike brokers such as Bitvavo and Bitladon, where you buy cryptocurrency and then store it in your own wallet, you never really own your bought stocks at eToro. You just buy a contract that is backed by the chosen stock.

However, you really own the crypto when you invest with eToro, and it ends up in an eToro wallet. When you want to invest in stocks, you do not really buy the stocks, but you enter into a contract with the broker. When you sell the stocks again, the contract is concluded. So, you bet money on the price of a stock without actually buying that stock.

This way of trading is exactly the same as with the more familiar Plus500. However, with Plus500 you do not have a wallet and the CFD system also applies to cryptocurrency. If you only want to speculate on the price of certain cryptos, then it should not be a problem. But if you also want to use cryptocurrency to pay for things, you should look for a broker where you can transfer cryptocurrency to your own wallet, like with eToro.

eToro uses leverages

Another important point are the leverages. As with Plus500, this is really something you should take into account. Chances are that you don’t know what leverages are. Please make sure that you fully understand what a leverage does, before using it. With a leverage you borrow money, to make your order bigger. It is a very risky instrument which can result in bigger profits. That might sound great, but it can also work the other way around. You can also have bigger losses.

Fortunately, there is a kind of security built in, so you won’t be bankrupt immediately, but if you don’t have any experience with leverages yet, it’s smart to do some research. In our knowledge base you can read more about leverages and margin trading.

eToro is a social trading platform

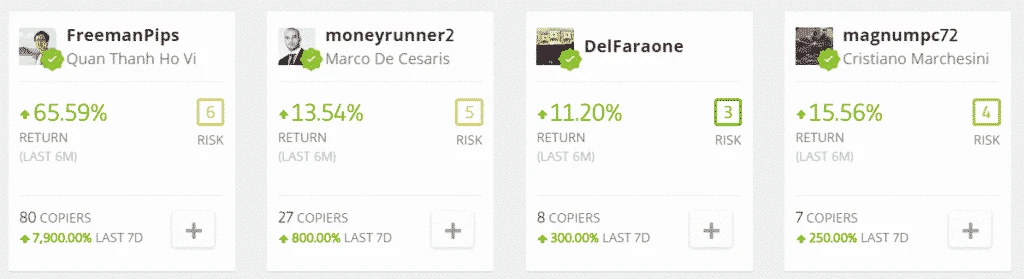

In the introduction we already mentioned that eToro is a social trading platform. When you think of being social and online, you might think of following people on Twitter or Instagram and being friends on Facebook. This is somewhat similar to eToro. On eToro, it is also possible to follow people to see what investments they are making. You can even indicate that you want to make the same investments as another person. That is entirely automatic.

So, you can follow the same strategy as a professional trader or even a whole team of traders. There is a large list of portfolios to choose from and it is a nice addition, especially for beginners. That way, you don’t have to do any research into the market yourself, but you can simply copy strategies from people who are good at it. Of course, this is no guarantee for profits either, but it does make it a lot easier. You can see how much profit a trader has generated and make a choice based on their results.

eToro review: More about the trading platform

So eToro puts a lot of emphasis on the social aspect. This is also clearly reflected in the site. For example, you get a personalized news feed within your dashboard, something we don’t see very often at brokers. eToro therefore does everything it can to get you involved in your investments and that’s very nice. The site itself looks clear and is most of the time offered in your own language. The blog and videos on the site are also in your own language. The site offers good support and has a special help center where all questions are answered. If you have a question that has not yet been answered in the help center, you can create your own ticket. The layout is very similar to Plus500 and that is certainly not negative.

One difference compared to Plus500 is that eToro offers more than 90 different cryptocurrencies within the platform. It can be quite interesting to invest in an altcoin with a leverage if you know what you are doing. You can see the current offer at this website: https://www.etoro.com/discover/markets/cryptocurrencies

How does eToro work?

To start trading with eToro, you create an account and make sure there is credit on your account. You do this by transferring money from your bank account. eToro accepts a lot of different payment methods, such as:

- Credit card

- PayPal

- UnionPay

- Skrill

- SOFORT

- Neteller

For your first deposit you need to deposit a minimum of $50 into your account (depending on your region). You can easily deposit euro and this will be converted to dollar.

After you have deposited credit into your account, you can buy cryptocurrency just like at other brokers. Pay attention to the leverage when buying. If you’re not very familiar with it yet, you should not use it. As with Plus500 you have the possibility to trade with a demo account. You can activate this in the menu under your profile picture. As a beginner, we advice you to use the demo account for at least 3 months.

eToro fees and costs

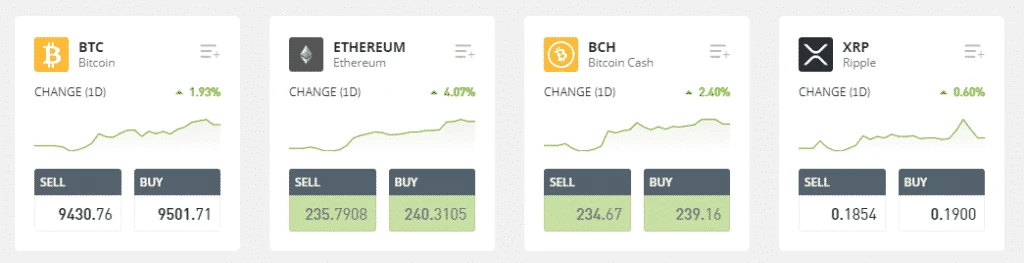

eToro does not work with fees, but with a market spread. This is a small fee that you have to pay when you purchase a cryptocurrency. It’s basically the same but has a different name. The market spread varies per currency and is between 5% for NEO and Stellar, for example, and 1.5% for Bitcoin. Although eToro advertises with commission free trading, the costs for this platform are very high. For example, if you choose to trade with Bitvavo, you only pay a fee of 0.25% per transaction. On the other hand, you can’t trade with leverage and you can’t copy strategies.

eToro does not work with an overnight premium for cryptocurrency, they do, however, for CFD investments. Also for depositing money, eToro does not charge a fee; for withdrawing money, however, they do. This is $5 per withdrawal and we think that’s quite a lot. The minimum amount you can withdraw is $ 50.

Is eToro safe?

eToro is a broker that really offers something unique with being a social platform. This gives novice traders the opportunity to invest profitably without research. Of course, when copying a strategy, you don’t always generate profits.

The world of brokers can be a bit dusty at times, because everyone offers the same thing in the same way. In any case, we like the concept, and the offer of more than 90 different cryptocurrencies is absolutely fine. The offer is even larger than the average cryptocurrency broker. This gives you a wide choice at eToro to speculate on the volatile market.

The costs charged by eToro may be a bit high, so you have to weigh up with other brokers whether you think it is worth it. If you value copying strategies or seeing the results of others, you can consider paying the high costs. eToro is a safe broker with more than 10 years of experience. They have many clients and the demo option makes it an attractive start for beginners. The marketing campaigns in Europe have greatly increased and you see eToro appear on more and more channels.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

Contact Details:

eToro (UK) Ltd.

24th floor, One Canada Square

Canary Wharf E14 5AB

London

FCA Number:

FRN 583263

Regulated by the Financial Conduct Authority (FCA).

Related:

Offer:

Limits:

All eToro reviews:

There are no reviews yet. Be the first one to write one.

Tell us what you think of eToro

Navigation