Why does Bitcoin crash whenever it reaches a new ATH?

Last Updated on 11 March 2024 by CryptoTips.eu

You may have noticed in recent weeks that every time Bitcoin sets a new record, whether it is $69,300 or $70,000, or $71k like this morning. That moment is always characterized by a crash of some 5% (when Bitcoin set its record of $70,000) to even 14% (when it hit $69,300). So why exactly is this?

At the time of writing, Bitcoin has just touched $71k and is trading around $71,700.

American stimulus checks

Back in 2020, hundreds of millions of Americans and Europeans were forced to stay at home due to Covid-19.

American families even received checks of $1,000 to as much as $2,000 to either get them through the difficult months or boost the economy, called “stimulus checks”. Younger generations called this ‘stimmy‘.

For many of them this was a welcome gift, because some had temporarily lost their work due to the corona pandemic, while for others it was simply ‘extra’ money that they invested in stocks and crypto. Converting your ‘stimmy’ into Bitcoin was very trendy back in 2021.

Robinhood and other investment apps took advantage of this. By introducing zero-fee trading to the youth, the wealthier members of the Gen-Z generation and Millenials started trading to their heart’s content.

Leveraged trading also became very popular. This meant that with a deposit of 100 Euro, for example, and a leverage of x10, you could simply double your deposit in one night if one or another cryptocurrency went up by some 10%. The Dogecoin saga of spring 2021 is an excellent example of this.

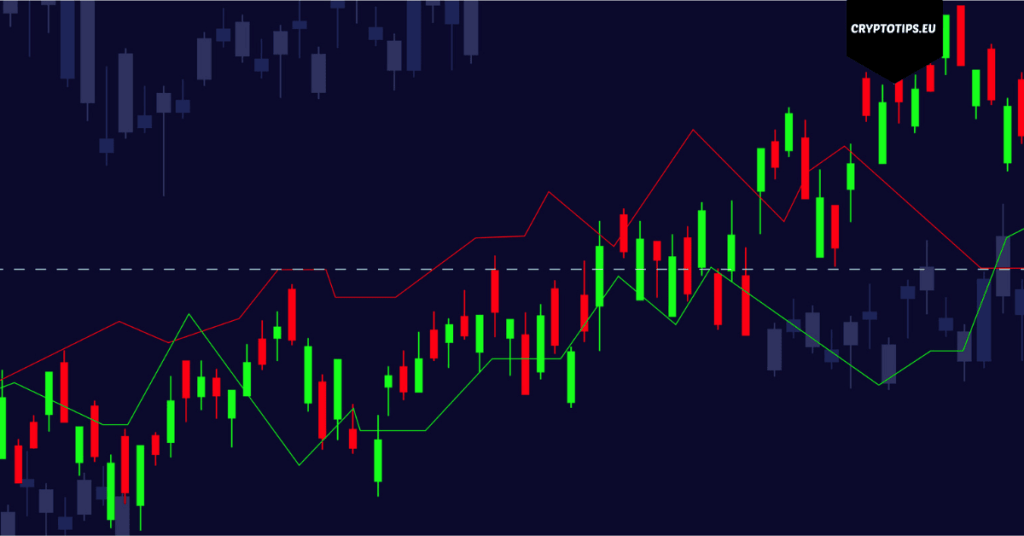

🧐Analyzing the latest #Bitcoin selloff heatmap on Binance: we've seen a surprise spike >$70k followed by massive selloffs. This suggests possible overexposure to leverage in the market. Are traders overconfident? Surveillance and risk management are key. #CryptoTrading #BTC pic.twitter.com/2D6JobGFyf

— Rami8612 Ⓟ (@rami8612) March 10, 2024

Leverage trading influences the price

The end of 2022 brought the bankruptcy of FTX and a Bitcoin price of $16,000. 2023 turned it all around again and when the Bitcoin ETFs were introduced in January of this year, all hell broke loose.

So now, just as the spring of 2024 is about to start, Bitcoin is again touching record prices and many of those young people who started trading on Robinhood in 2020 have all learned to trade with leverage.

So every time Bitcoin hits a record, hundreds to thousands of automatic sell orders kick in, causing the price to drop very quickly of course. After that, as from the moment Bitcoin is trading at about $5,000 lower again, they automatically buy more.

Maybe if all these degenerates would stop getting long with historically high funding rates and 100x leverage we wouldn’t see a flush every time bitcoin reaches a high.

— The Wolf Of All Streets (@scottmelker) March 8, 2024

‘Bitcoin maxis‘ such as Scott Melker, who tweet under the moniker Wolf of All Streets, have also recognized the phenomenon and do not find it very funny.