Whale Warning: “99% of DeFi tokens are scams”

Last Updated on 11 September 2020 by CryptoTips.eu

A message probably written in anger is sending a ripple effect through the crypto world. A known Whale crypto investor was furious when another DeFi project exit scammed and investors lost their money.

Read more about DeFi begin a possible bubble.

Whale warning

A Whale in crypto is a so-called major investor who is able to move coins with a value of millions or billions of dollars. When some of them cooperate, as Bitcoin has experienced in the past few months, and all exit a coin at the same time, they can cause what is known as a flash crash, to the detriment of smaller investors.

On the other hand, when they buy a startup coin and then get exit scammed (the original developers sell all their own coins and crash the value of the coin in the process) they stand to lose massive amounts of money whereas smaller traders only lose their initial investment.

Defi Project https://t.co/B2bZFu9GLl Vanishes With $20M Investors’ Funds Just Two Days After Launch https://t.co/PxLN0WXMgE pic.twitter.com/iJrmxDlv7s

— Bitcoin News (@BTCTN) September 11, 2020

One of those Whales that got exit-scammed was a trader that tweets by the moniker CryptoWhale. Although no one knows his true identity, the man is clearly American given the never forget picture he posted (today’s 11 September) a few hours ago.

- Also read: Top 6 scam methods in cryptocurrency

In anger over what happened to a new liquidity mining pool DeFi project called Yfdexf.Finance, he stated that:

99.99% of DeFi tokens are scams designed to steal your wealth.

Yearn Finance

His emotional outburst followed the exit scam of a coin named Yfdexf.Finance (which had clearly chosen its name to resemble YFI or Yearn Finance), a coin that had picked up some $20 million in investment after it was touted heavily on several Medium, Twitter, and Telegram accounts. Just as happened with Sushi, the developer had kept several million coins for himself, he waited until the value of the coin went up because of the marketing efforts and then exited.

99.99% of DeFi tokens on the market are scams designed to steal your wealth.

— CryptoWhale (@CryptoWhale) September 10, 2020

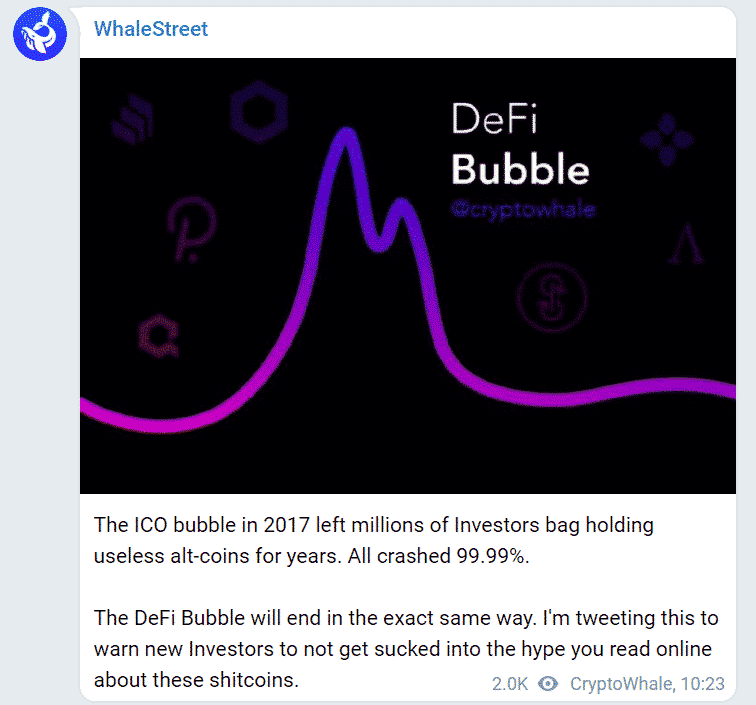

Anyone who disagrees likely wasn’t around during the last ICO bubble which resulted in 99.99% of coins popping, and crashing over 99%

By now, the coin’s official website and all social media accounts have been deleted, leaving investors with a hole in their pocket and another warning in their mind.

On Telegram, CryptoWhale stated:

The ICO bubble in 2017 left millions of Investors bag holding useless alt-coins for years. All crashed 99.99%. The DeFi Bubble will end in the exact same way. This to warn new Investors to not get sucked into the hype you read online about these shitcoins.