Uniswap (UNI)

Last Updated on 8 April 2024 by CryptoTips.eu

If you have heard of Decentralized Finance (DeFi), you probably have also heard of Uniswap (UNI). It belongs to a class of assets known as Automated Market Makers (AMM). This means that Uniswap makes it possible to trade DeFi tokens automatically without much human intervention.

After launching in November 2018, not much was heard of it until the 2020 DeFi boom. Uniswap turned out to be one of the leading projects during the boom and has grown in relevance continuously till today.

One thing that may have set this project part is the fact that it opens the door for anyone to be able to trade DeFi tokens automatically without any central control. This is what Decentralized Finance is about. After listing on Coin Market Cap, Uniswap rose fast to become the 15th largest cryptocurrency at the time of writing this article.

As the ecosystem continues to grow because of the opportunities it holds to make lives better, the project is also likely to become more relevant, hence the need to explore. This article discusses the Uniswap protocol with everything it is about and why you may wish to keep an eye on it.

- Uniswap

(UNI) - Price $3.26

- Market Cap

$2.07 B

Uniswap (UNI)

More information

What is Uniswap?

As earlier stated, Uniswap is simply a trading protocol for DeFi tokens. The difference between protocols like Uniswap and other crypto exchanges goes beyond just being decentralized to being automated.

As earlier stated, Uniswap is simply a trading protocol for DeFi tokens. The difference between protocols like Uniswap and other crypto exchanges goes beyond just being decentralized to being automated.

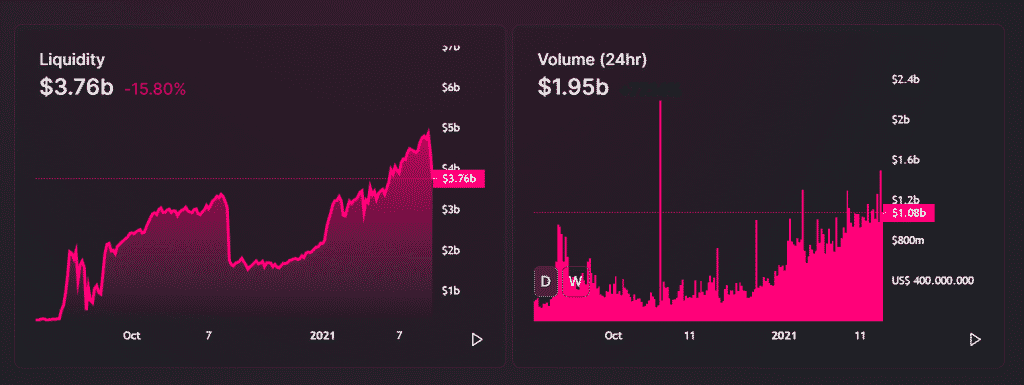

Uniswap’s design makes it to solve many problems in the DeFi ecosystem, key among which is ensuring that the liquidity pool never runs dry. This is a great feature that makes it possible for any number of people interested in DeFi tokens to be able to trade their tokens smoothly without problems which characterized the decentralized exchanges that existed before Uniswap. This makes it unsurprising that the project has grown so fast compared to the others.

One critical characteristic of decentralized systems is the ability of individuals to participate in the governance system. To ensure such is fully implemented on Uniswap, the team behind it created a native governance token known as UNI. After its creation, the UNI tokens were distributed to members of the community who had used the protocol at some point in the past. This was one of the biggest airdrops with each qualified user receiving an equivalent of 400 UNI.

Uniswap’s identity cannot be separated from Ethereum. For one thing, it is powered by Ethereum, the base for DeFi tokens and projects. Even more interesting is the fact that its creator, Hayden Adams is an Ethereum developer who got the idea for the protocol from Ethereum’s Vitalik Buterin.

How does Uniswap work?

A lot of crypto investors and traders may ask this question because centralized crypto exchanges are far more popular in the space. One reason for this is because they were the first to arrive after the industry started.

Exchanges like Uniswap however operate differently by allowing users to swap ERC-20 (tokens built on the Ethereum blockchain) without any central supervision. On centralized exchanges, this is done using an order book, which gives the exchange some level of control over trades.

Uniswap uses smart contracts to pool tokens and use them as liquidity pools that are used to trade tokens. Unlike on centralized exchanges where fees are charged by the exchange, Uniswap allows any of its users to add their tokens to the pool and they pay fees when trades are done using such pools. This is an incentive program that ensures there are always contributions to the pool so that it doesn’t run dry. Anyone can also list tokens on the exchange free of charge.

Users contributing to the liquidity pool have what is called liquidity tokens sent to their wallet addresses as some form of insurance. This is because the contribution to the pool is locked and inaccessible until the user wants to withdraw his contribution. At this point, the liquidity tokens are burnt and they are given back their tokens with their share of the transaction fees during the time their tokens were in the pool.

This provides an opportunity for ERC-20 token holders to profit from their assets by just contributing them to the pool. Over time, the transaction fees accumulate and become a significant reward for providing liquidity. This makes it a win-win for every member of the community and is one of the reasons why decentralized systems are so powerful.

ERC-20 tokens are basically swapped against Ether, but token to token swaps are also possible. The latter however costs double (0.6%) of swap amount while the other only costs 0.3%. It should be noted that transaction fees are paid using Ether regardless of the kind of transaction since the tokens run on the Ethereum blockchain.

This is the reason why fees for DeFi transactions rose significantly in 2020 and is still a problem. Hopefully the issue will be resolved soon as Ethereum is working with Polygon (MATIC) to increase scalability and thus cut fees.

Features of Uniswap Protocol

Although there is so much to say about Uniswap, the protocol can be broken down into the following major features.

- Automated Market: Uniswap is an automated market maker. This is probably the most important feature of the protocol, making automated trading of DeFi tokens possible.

- Active community participation: Uniswap gives power to the community to decide on the governance in many ways, one of which is that members contribute to the liquidity pool that keeps the exchange going.

- No identity requirements: A major concern for internet users and especially crypto traders is the issue of identity. On Uniswap, there are no such requirements and anyone can participate while keeping their identity secret.

- Decentralized market: When it comes to Uniswap, there is no central figure to decide who does what and how. The system makes every member of the community an automatic stakeholder.

What Are the Governance Protocols of Uniswap?

Uniswap has a rather unique governance protocol. Although decisions on the protocol’s governance and upgrades are made by the community of UNI holders, the process is made up of three components. These are:

- UNI Token: Members of the Uniswap community who hold up to 10 million UNI tokens are allowed to propose changes to the current governance. Votes are then cast over a period of 3 days by the rest of the community. The proposed change will be scheduled for execution in at least 2 if it has at least 4 million votes in its favour.

- Time Clock: proposals for governance change that pass the votes are queued for execution on the Time Lock. It takes at least 2 days to move from this stage to actual implementation. The amount of time a proposed governance action stays at this stage depends on the significance of such a change, some reaching up to 30 days.

- Governance Module: Governance Module controls the Time Cock which. All concluded and pending governance action proposals are monitored on the Time Clock dashboard by the Governance Module.

The UNI token has only one purpose on the Uniswap Protocol: Governance. Token holders have the right to participate in how the protocol is run and with their tokens, can vote to influence decisions. In the near future, UNI token holders will take full control of the protocol governance when developers finally withdraw from governance issues.

This will entrust even more power to the hands of the token holders.

Pros of Uniswap (UNI)

UNI Tokens have a number of advantages (pros), some of which are:

- Ability to function as a currency: UNI Tokens have the ability to be used as a currency. This is possible because the token has a perpetual inflation rate of 2%. An inflation rate is one characteristic of a currency that most cryptocurrencies such as Bitcoin don’t have, but UNI has.

- Community owned: Unlike centralized exchanges, Uniswap is a fully decentralized trading platform that is owned and governed by the community of UNI Token holders. This is a major strength for Uniswap and its governance token.

- Automatic liquidity: With Uniswap, there is no fear of liquidity shortage. This is due to the fact that the platform is an automatic market maker. Token holders contribute to the liquidity pool and are incentivized by receiving 40% of the fees commission paid during the time their tokens are in the pool.

- No registration or KYC: No need for registration or KYC is another powerful characteristic of Uniswap. Exchange users are becoming increasingly concerned about their privacy and this is a big plus for the platform. No wonder Uniswap grew so fast to become one of the top DeFi tokens in no time.

- Easy listing of tokens: Uniswap allows anyone to list their tokens independently without any central approval. Considering the red tape involved in listing on centralized exchanges, most people would list on Uniswap first. This makes it a goto venue to access new tokens as they are released.

- Low fees: Uniswap charges a flat transaction fee of 0.3%. This is way cheaper than the fees other decentralized and even centralized exchanges charge.

Cons of Uniswap (UNI)

As good as Uniswap is, it also has its own weaknesses as follows:

- Fake tokens: A fully decentralized protocol is an advantage. However for Uniswap, some dubious projects have taken advantage of the system to infiltrate it with fake tokens. This is why it is advised that users do thorough research before deciding which pair of tokens to trade.

- Not a good store of value: A good store of value is a cryptocurrency such as Bitcoin with a capped supply and no inflation. Having inflation rate makes UNI more like a currency that depreciates over time and so is not a good store of value.

- Failed transactions: On Uniswap, transactions are bound to fail. This could be due to low gas fees which could make it to be rejected by miners. Another reason is fluctuation in the prices of tokens after you have chosen a price at which to pay and thirdly due to low liquidity which is unlikely due to the way Uniswap is designed to ensure liquidity is maintained at a high level.

- Limited by the Ethereum blockchain: The high Ethereum gas fees makes it very expensive to use the platform.

In summary

Uniswap is by far one of the best DeFi projects. Because of its setup, it has attracted a significant number of users in a short time and is now one of the leading decentralized exchanges.

Because of the popularity of Uniswap protocol, even its token, UNI has also become very popular and has grown in value rather fast. The features of the protocol and the technology gives both the exchange and its token an unique advantage over competitors in the DeFi ecosystem.

It’s too bad that the performance is currently limited by the Ethereum blockchain, but we hope that it will be fixed soon.

Navigation