Synthetix (SNX)

Last Updated on 28 December 2020 by CryptoTips.eu

Synthetix is a decentralized finance (DeFi) project that runs on the Ethereum blockchain. From a different angle, it can be defined as an assembly of smart contracts that grants its service users the ability to mint new cryptocurrency. The new currency mirrors the traditional fiat currency like the USD or even significant crypto assets like Bitcoin or ETH.

The new currencies get minted through a process of code execution, technically known as collateralization. To initiate this process, the service user needs to purchase the Synthetix platform’s native cryptocurrency SNX. The users then put trust in the programmed code and commit the SNX to a smart contract that mints the new currencies given the name Synths.

For instance, sUSD is the acronym designated for synths that imitate the USD. On the other hand, sBTC is the acronym for those synths that replicate the Bitcoin.

- Synthetix Network

(SNX) - Price $1.97

- Market Cap

$666.97 M

More information

The SNX Token

The Synthetix DeFi platform derives its name from its capacity to allow the formation of synthetic crypto assets (Synths). Since the Synths get created from the Synthetix platform’s currency, Synthetix Network Token (SNX), we can safely conclude that the SNX is the utility token of Sythetix.

The value of a single SNX token shot upwards from a value of 0.79USD to 3.32 USD in the mid of 2020. However, it is currently at the 6.02 USD mark. There is a projection of creating 250 million tokens, within five years from now.

The supply of SNX was initially deflationary and discouraged stakers from creating synths. The adoption of an inflationary policy early last year corrected this challenge. Synthetic started with the name Havven, with an Initial Coin Offering of 100 million tokens valued at 30 million USD. The current number of coins is well over 160 million after the enactment of this policy.

Users are now incentivized to mint an increased number of synthetic currencies due to the ample supply. This incentive creates a pull towards the adoption of the network and thus gives the SNX token its value. The value rises as the as more users join the network opening the avenue for minting more Synths.

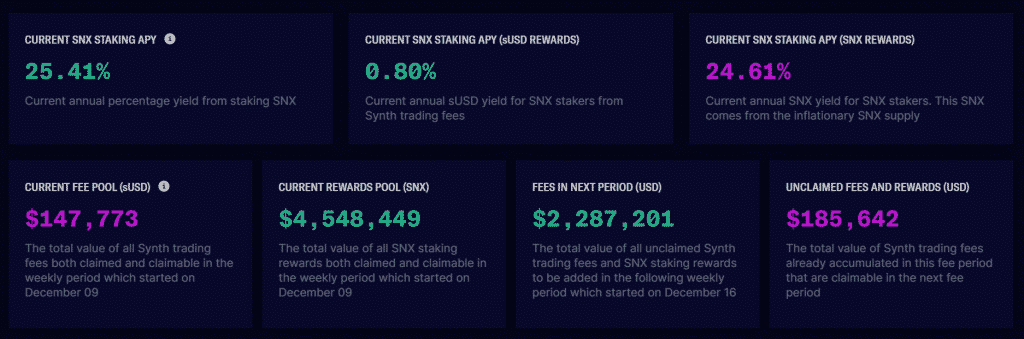

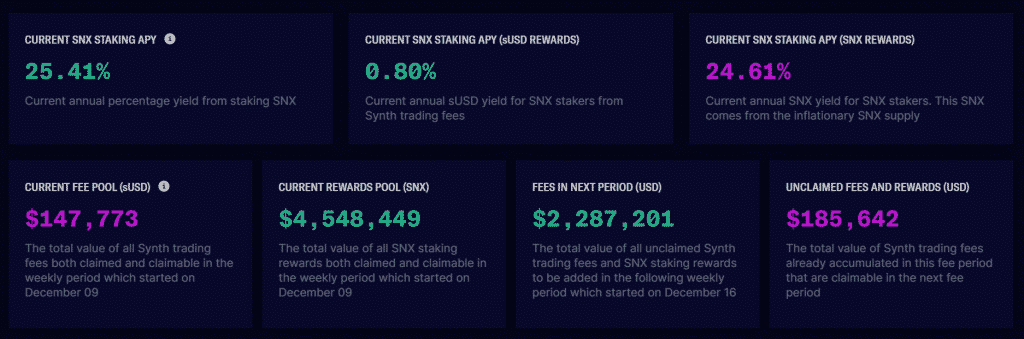

SNX is committed as the collateral in the creation of synthetic currency. The motivation for such contracts on the part of the staker who owns a given unit of SNX is that they earn trading fees which are divided amongst themselves.

Generating Synthetic Currency From SNX

The number of Synths created corresponds to the SNX value that a staker holds. Currently, the minting ratio is 8 SNX to 1 Synth. However, if the user wants to use ETH instead of SNX, then the collateralization ratio drops to 1 Synth for every 5 ETH.

Late 2018 saw Synthetic changed its name from Havven (HAV). The upgrade came with the introduction of new Synth assets which tracks the values of popular fiat currencies, late 2020. The sUSD which simulates the value of the United States Dollar was the first stablecoin (synthetic asset) introduced in June 2020. The other fiat currencies introduced a bit later are the Euro, AUD, Japanese Yen, KRW and then gold.

Users can buy Synthetix from crypto exchanges. Still, they are held in crypto wallets adaptable to the Ethereum blockchain. When stored in a crypto wallet, staking can be done when the staker wishes. Uniswap and Kyber are two decentralized exchanges where you can buy SNX.

Ultimately, the Synthetix project has released a decentralized app, known as Mintr, which helps stakers in the process of creating synths. Owners of the SNX tokens have so far created sUSD synths with a value more than 1.5 million USD.

The Synth Token

The name synth token refers to tokens created from the staked SNX token and which are an imitation of the value of real assets. They give a link to popular assets like USD, BTC, gold, TESLA and AAPL on the Ethereum platform. Synths, symbolized by a lower case “s” inserted before the asset symbol.

The name synth token refers to tokens created from the staked SNX token and which are an imitation of the value of real assets. They give a link to popular assets like USD, BTC, gold, TESLA and AAPL on the Ethereum platform. Synths, symbolized by a lower case “s” inserted before the asset symbol.

Synths come in diverse forms like fiat synths, stock synths, crypto synths gold synth and even DeFi index synths.

Fiat synths for the synthetic Euro and synthetic dollar are denoted by symbols sEUR and sUSD, respectively.

Stock synths could also be minted for high demand stocks like Tesla and Apple. Their symbols would be sTSLA and sAAPL, respectively.

Synthetic gold is denoted as sAu.

When a new Synth is created, a debt is made. The deficit establishes the necessity of payback of synths of the same value as the debt created before the staker can withdraw the staked SNX tokens. The SNX tokens thus act as collateral in the creation of synthetic assets

SNX tokens usually provide the needed back up, and the system is set to allow the staker to commit SNX tokens that is five times more than the Synth to be created.

This change in value prompts users to pay a synth amount that is more or less the amount created before when they withdraw their SNX.

However, the debt can be paid with a Synth different from the one that was minted provided their value are the same.

Synthetic Nature of Synths Tokens

If you hold sBTC, you will be prone to the volatility of Bitcoin. The same applies to share synths, but because they are synthetic shares, you won’t be able to earn dividends like the ordinary shareholders. The reason is that synthetic tokens, as their name suggests, are not entirely a duplicate of the assets they mimic.

Several platforms have adopted the Synthetix protocol and thus use Synthetic assets of traditional currencies like USD and ETH.

Curve Finance, for instance, has adopted the USD synth.

The Synthetix DEX

The Sythetix.Exchange is the platform that handles the buying and selling of Synths, but a new decentralized app named Kwenta is coming soon. Kwenta is expected to run on the cutting-edge trading technology on the Synthetix protocol.

If the user has a decentralized app enabled crypto wallet like MetaMask, then what remains is connecting it to the exchange. Right now, the Synthetix decentralized exchange can accommodate at least 19 assets with 31 trading sets.

Stakers enjoy maker and taker fees of 0.30%. The standard roof limit in the crypto industry is 0.25%. The levies act as their reward for injecting liquidity onto the Synthetix ecosystem.

Further, the Ethereum blockchain levies its users gas fees based on the number of transactions. The charges become exorbitant for numerous transactions and discourage the use of the decentralized exchanges. However, with Ethereum 2.0 on the offing, scalability adjustments are expected to reduce the gas fees drastically.

Luckily, decentralized exchange’ users don’t incur withdrawal fees for wallet-to-wallet transfers. however, the users incur gas fees

The Scalability of Synthetix

One of the upgrade features on Ethereum is the Optimistic Ethereum that offers DeFi applications the opportunity to run on Layer 2 instead of the base layer of the blockchain.

At the moment Synthetix is running tests for their first step in adopting the L2 testnet

The transition will provide opportunities for SNX stakers with limited collateral to participate in staking since the gas fees that hindered their participation will be lowered.

Further, in the strategic plan of the project is the Synthetic Futures product that will boost the values that the stakers can trade-in regardless of the amounts they hold in their wallets.

Advantages of Synthetix

The Synthetix platform offers several benefits, as listed below.

- Apart from helping users estimate the present moment prices of real-world assets through an oracle feed, the Synthetix platform has no KYC restrictions for its users. There’s no need of an user account, yet you can gain access to high demand shares, high premium bonds, property and much more.

- Stakers that mint synths and obtain passive income from the levies imposed on the buyers of the assets. The incentives give the reason why more than 80% of the total SNX supply is at the moment locked up in contracts.

- The Synthetix ecosystem has the capacity to move millions of dollars in value of assets from the fiat markets to the Ethereum ecosystem.

- The platform’s native token is available at a favorable price on exchanges. For low fees and discounts, you can compare these exchanges.

- Synthetix links Ethereum blockchain users to assets not available on their chain.

- The peer-to-contract mechanism for buying and selling synths eradicates the challenges of liquidity.

Downside of Synthetix

Synthetix, like many other cryptocurrencies, is very risky. The prices are so volatile and could change within a blink of an eye. A trader could complete their trade without a profit or even with a loss.

The Synthetix platform charges a 0.30% transaction fee on makers and takers. That is 0.20% more expensive than the roof limit of the standard market price for such services. The cost is necessary for rewarding stakers who inject liquidity onto the Synthetix platform.

Summing Up

Synthetix is a top-notch DeFi project that promises favorable future transitions due to its already high utility among users need to trade in their favorite Synths.

With the supply of SNX tokens expected to rise by more than 50 million in the next three years, Synthetix is expected to draw more users to its platform. The prospect of profit on the SNX staking platform is indeed an incentive for new users.

Synthetix has taken its first step into Ethereum’s scalability plan “Optimistic Ethereum”. In the new upgrade, contracts will be much more convenient and cheaper.

Navigation