Ren (REN)

Last Updated on 8 April 2024 by CryptoTips.eu

Ren project is the creation of Taiyang Zhang and L. Wang and started as the Republic Protocol in 2017. Its vision was to decentralize over-the-counter (OTC) trading and setting up a system to enhance interoperability between different blockchains.

The duo had exchanged ideas on how crucial it would be to create a protocol that hid huge OTC transactions on a public blockchain. Further, they saw the need for the same protocol to possess the ability to interface different blockchains.

Thus, in a nutshell, the entire Ren project aimed at boosting privacy, guaranteeing the safety of transactions, and interoperability in over-the-counter crypto activities.

Zhang and Wang believed that the said three pillars would ultimately decentralize OTC. The Ethereum blockchain hosts the protocol.

- Ren

(REN) - Price $0.031

- Market Cap

$31.2 M

Ren (REN)

More information

Ren Initial Coin Offering

The Ren protocol managed to sell more than 55% of their REN token supply of 1 billion. The price of a single token was slightly above $ 0.05.

The Ren protocol managed to sell more than 55% of their REN token supply of 1 billion. The price of a single token was slightly above $ 0.05.

The first ICO conducted in January 2018 was private but managed to register sales of up to $28M. However, the second but last Initial Coin Offering, in February 2018, was made public and managed to raise $4.8M. The crypto hype was by then declining.

Some of the coin’s significant investors were FBG Capital, Polychain, Signum Capital, and Synapse Capital.

The Ren Token

According to above statistic, the Ren token has a current price of 0.27 USD and ranked number 67 with a market capitalization of 246 Million USD. The token has a circulating supply of approximately 884.5 Million out of the total supply of roughly 1 billion.

The ERC-20 based coin has experienced a small drop in price, but a significant drop in market cap in the last two months after the ICO. However, the price fluctuations of significantly low and notably high cycles in 2019 drew crypto investors’ attention. The coin dropped in price to 0.08 USD shortly after the last crowdfunding in February 2018.

The Ren token has a significant role in settling the trading fees for orders executed on the Ren virtual machine (RVM). Moreover, there is a requirement of 100,000 REN bond for users who choose to operate a darknode on the Ren platform. The system settles the bond in REN. Ren requires the operators to pay the bond to discourage them from fraudulent activities.

A darknode ushers you into a REN darkpool. The darkpool is simply a private crypto marketplace where trade figures and identities get hidden from the public eye. Running a darknode attracts transaction fees for the service offered.

After the two ICO’s, the investors purchased approximately 60% of the entire token number. Their reserve fund takes up approximately 20% of the total supply. The pioneers, advisors, and team shared 10%. Ultimately the remaining 10% goes to partnerships or anything related to that.

Exploring the Operations of Ren

Before exploring how the Ren protocol works, we need first to understand what RenVM is. Subsequently, we will link that knowledge with the notion of a darkpool.

Ren’s target achievement is a private devolved trading protocol which can interact with other blockchains. Only their network, RenVM, can achieve the intended private but decentralized programs.

RenVM is a devolved virtual machine that mimics a blockchain. Ren allows the cloning of the program across thousands of computing devices. Since the node operation is devolved, anyone can access the virtual machine. Commands are implemented by the system even when a computer is offline.

The numerous virtual private servers make the RenVM “engine” by bringing together their bandwidth, computing resources, and storage capacity. The numerous computers are known as darknodes, and their services earn some rewards from the Ren network.

In another sense, RenVM is the system of interconnected virtual computers (darknodes).

The darknodes must keep a continuous cycle of exchanging information with other darknodes worldwide to achieve their intended function.

Darkpools refer to the private OTC crypto exchanges that facilitate incognito purchases of large amounts of crypto or whatever asset. However, the investor has to trust the centralized mediator to keep the transactions private and safe. In our case, Ren is a centralized mediator.

How RenVM Achieves Privacy and Interoperability

Through a complex algorithm, RenVM shards the orders to hide from the darknodes the currency transacted, amount, and target.

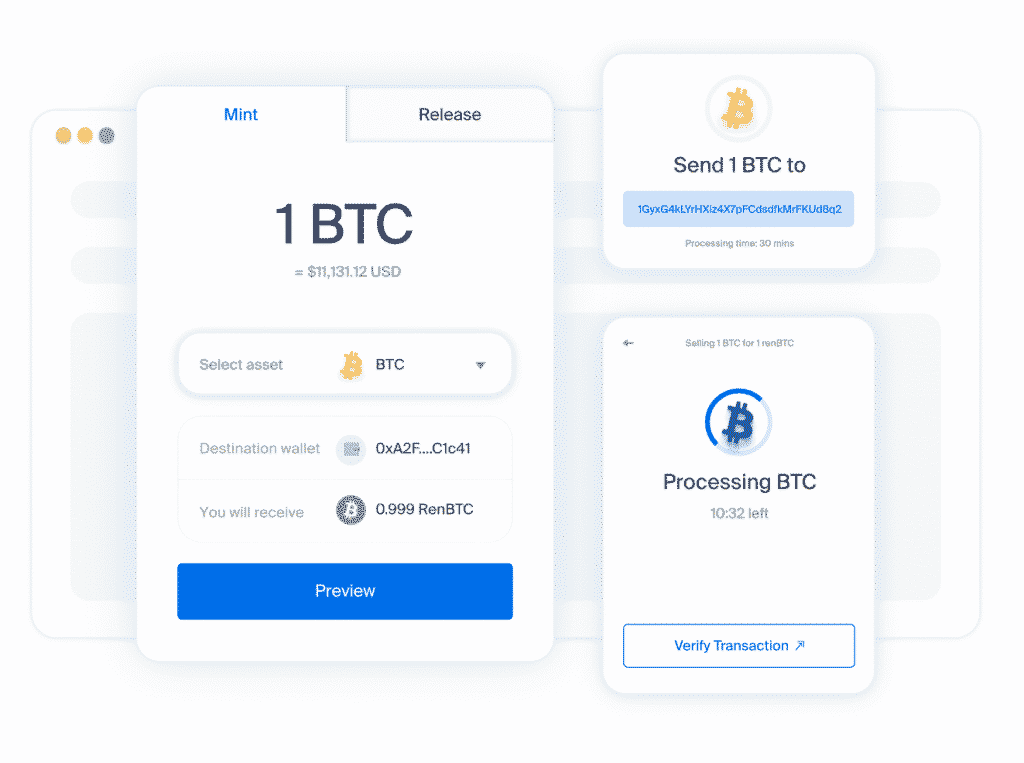

Transactions involving transfer between multiple exchanges are done on RenVM’s host blockchain Ethereum, using ERC-20 tokens whose value is equal to the currency transacted.

For instance, if you’re using BTC, you don’t move it to the Ethereum chain. The ERC-20 token makes it possible for you to transfer or exchange the BTC on the Ethereum blockchain.

A masked identity during the anonymous trade creates mistrust and security concerns. RenVM bridged this gap by providing a trustless, devolved protocol with enough security mechanisms.

By making the permissionless giving and taking of assets from one blockchain to another possible, Ren Virtual Machine brings interoperability to Decentralized Finance.

Consequently, DeFi’s utility grows, and the liquidity of the host blockchain soars.

Additionally, DeFi programs can integrate RenVM into their software to tap into the increased liquidity due to ‘connecting’ blockchains.

Ren’s Milestones

Ren stands out from among other crypto projects for its regular public announcements on the milestones it has reached through sites like Medium and Github.

At the beginning of 2019, Ren made a significant change of approach heralded by the change of name from Republic Protocol. Ren then shifted its attention from devolved darkpools to devolved interoperability for crypto blockchains.

The same year saw Ren invent Subzero, their initial invention of RenVM mainnet. Ren split the development phase into two. Chaosnet was the last implementation in November 2019. Testnet, however, preceded it in August 2019.

In both phases, the team behind the upgrade collected community reviews and used them to fine-tune the protocol. The exercise was so important that they promised rewards to reviewers who identified and communicated bugs on the platform.

In the first three months of 2020, Ren set up Ren Alliance. The alliance was a coming together of entities or projects interested in either evolving, securing, or even using RenVM. Simply put, the alliance would draw together new members, shareholders, and developers to the project.

Ren gave one condition for the interested members: a great aspiration to move cross-chain assets to decentralized finance (DeFi).

The alliance’s move would introduce assets from other blockchains and thus boost the use of DeFi. Building the Ren Alliance membership would make it a more vital permissionless element in the DeFi arena. The membership was over 45 by May 2020 and included big names like Kyber Network, 0x, Uniswap and Balancer.

In May 2020, Ren evolved further and introduced RenVM SubZero, where users could use BTC, BCH, or Zcash in any decentralized finance applications.

The contrast with the old way of doing this was that the former was not decentralized and trustless.

Though not many crypto markets support Ren, it can be found on major exchanges like Binance. You can see here where you can buy Ren.

Storage of Ren

REN has ERC-20 attributes. Thus, any wallet that is compatible with the Ethereum blockchain can store it. There is an ample supply of such; it all boils down to your choice: software or hardware version.

Excellent versions compatible with smartphones are the Atomic Wallet and Trust Wallet.

Ledger is a good choice for hardware wallets.

The Exodus Wallet can work on smartphones and personal computers. My Ether Wallet is also compatible with REN.

Pros of Ren

- Ren’s interoperability gives crypto users the ability to interchange tokens across blockchains even without the old way of “wrapping” tokens.

- According to ChainSecurity’s audit on their smart contracts, their protocol is sufficiently secure.

- Ren boosts liquidity on the Ethereum blockchain’s DeFi by drawing in value from other blockchains.

- Notable investors find the project fascinating.

- Ren has initiated strong measures against fraudulent users on their platform.

- Their social media sites are well managed.

- Ren’s leadership is composed of experienced professionals. For instance, Zhang, the CEO, has a history of software engineering. Wang, the Chief Technology Officer, has once served as a software developer.

- Ren has partnerships with renowned and reputable organizations and service providers like Wyre, TrueUSD, and Kyber Network.

Cons of Ren

- Understanding the technology behind the operations of Ren is beyond a crypto layman. Grasping the concept requires some extended exposure to crypto trading.

- The REN token price is low, and it may take time to rise to an optimal level.

- Ren’s website requires some development in its design.

- It promises a decentralized platform, but it’s not yet there.

- OTC trading doesn’t pride a crucial selling point since it’s only a service sought by affluent investors.

Conclusion

Ren has formidable business rivals when it comes to interoperability. Polkadot and Cosmos are some of them. Synthetix and Tokenlon give Ren a run for their money on BTC tokens service.

However, Ren sets itself apart in offering a single complete package of the three solutions blockchain liquidity, privacy, and connecting a blockchain with another. The introduction of RenVM is central to its achievements of pulling BTC to the Ethereum blockchain.

Their success, however, is hinged on the security of the platform and how well they attract developers.

Navigation